46+ what is the debt to income ratio for mortgage

Trusted VA Loan Lender of 300000 Veterans Nationwide. Ad See how much house you can afford.

Financial Health And Sense Of Coherence Barnard Sa Journal Of Human Resource Management

Highest Satisfaction for Home Loan Origination.

. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Web Expressed as a percentage your debt-to-income ratio for a mortgage is the portion of your gross monthly income pre-tax spent on repaying debts including. Earnings available for distribution.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan.

This includes cumulative debt payments so think credit card. Web While requirements for approval will vary between loan types a general guideline is to have a debt-to-income ratio of below 36 for a greater likelihood of loan. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Estimate your monthly mortgage payment. Lock Your Rate Today. Ad Compare Home Financing Options Online Get Quotes.

Web Monthly debt obligations of 3000 divided by gross monthly income of 7000 is 0429. In this formula total monthly debt. Only Takes Minutes to Get Preapproved with a VA Lender.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend. Ad 10 Best House Loan Lenders Compared Reviewed. Web In the consumer mortgage industry debt-to-income ratio often abbreviated DTI is the percentage of a consumers monthly gross income that goes toward paying debts.

Web Calculating your DTI ratio is simple. Trusted VA Loan Lender of 300000 Veterans Nationwide. Well Help You Estimate Your Monthly Payment.

Your DTI helps a mortgage lender determine. A DTI of 43 is typically the highest. Web Whats the maximum DTI for a home loan.

Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments. Need To Know How Much You Can Afford. But each mortgage lender.

Comparisons Trusted by 55000000. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

If youre seeking a. Generally a good debt-to-income ratiois around 36 or less and not higher than 43. Total your monthly bills and divide that number by your gross monthly income or your pay before taxes or other deductions.

Apply Online To Enjoy A Service. Web Debt-to-Income Ratio Calculator. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

Your debt-to-income ratio is a measurement lenders use to find out how much of your income goes toward paying off debt every. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan. Web The debt-to-income ratio compares a borrowers monthly debt payments to their monthly gross income.

Web About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright. Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Web Heres how the debt-to-income ratio is calculated.

When someone applies for a home loan lenders use the ratio to help. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Web What Is Debt-to-Income Ratio.

Multiply by 100 to get 429 or a DTI ratio of 43. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Only Takes Minutes to Get Preapproved with a VA Lender.

Web If you have a DTI of 50 or higher then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio. Web The Company earned 259 million of net interest income in the fourth quarter compared to 317 million in the third quarter. Web Debt-to-income ratio DTI is a comparison between your monthly debt payments and your gross monthly income.

Lenders prefer to see a debt-to. Debt can be harder to manage if your DTI ratio falls between.

Debt To Income Ratio What It Is How To Calculate Yours

What Is The Debt To Income Ratio Learn More Citizens Bank

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is Debt To Income Ratio How Do I Calculate My Dti

How Debt To Income Ratio Dti Affects Mortgages

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

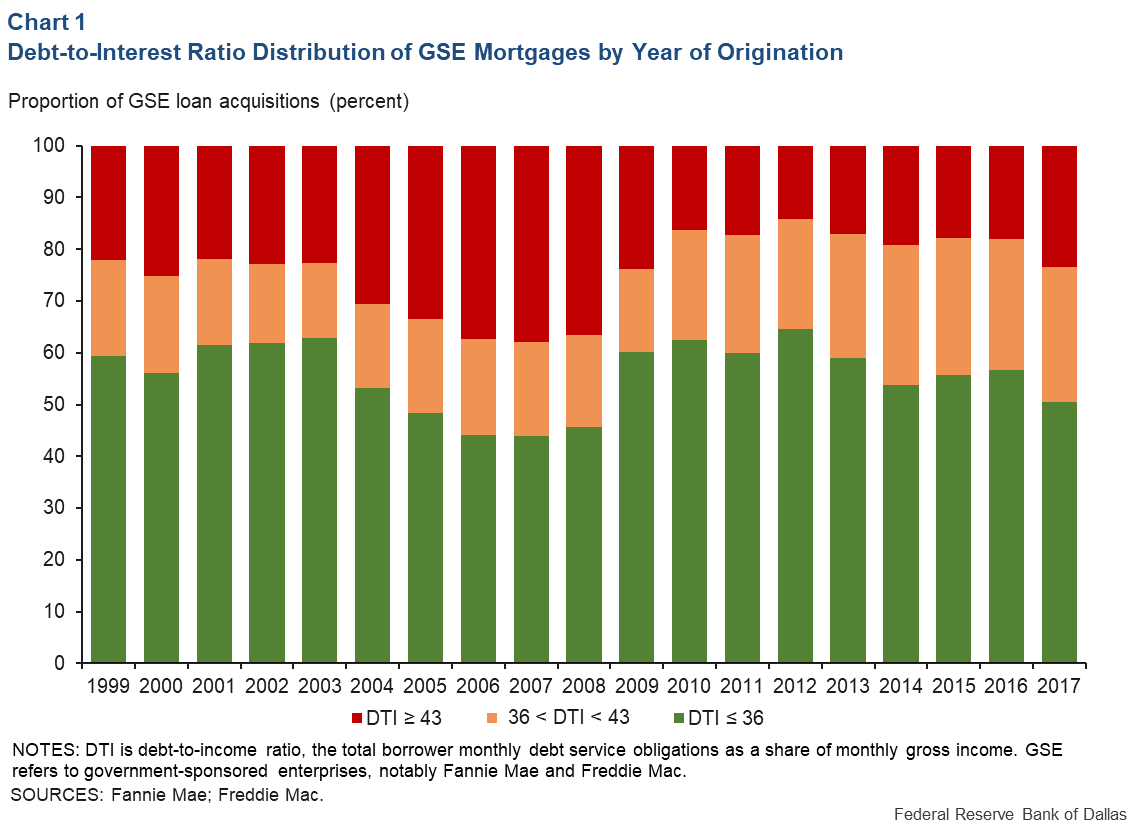

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

Debt To Income Dti Ratio Calculator Money

Debt To Income Dti Ratio Calculator Money

![]()

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Dti Ratio Calculator Money

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

Debt To Income Ratio Calculator Interactive Hauseit Nyc

Debt To Income Dti Ratio Calculator Money

Financial Health And Sense Of Coherence Barnard Sa Journal Of Human Resource Management

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator